Coin Investing in 2026

It’s possible this is the first page you’ve landed on here at Rare Coins 101. If so, welcome aboard, and thank you so much for your time, where it is appreciated and respected.

Presumably, the reason you are here is to learn more about coin investing and what are the best coins to buy now in 2026 and have the potential for steadily rising in value as the future unfolds.

Sidebar: Wanting a timely update on the current status of the rare coin marketplace? You’ll find that info over at the Collectors Rare Coin Index.

We’ll get into that momentarily, but first we must review evidential truths presented in the preceding chapters of the Rare Coins as an Investment section. Those of you who linked to here from those chapters are already familiar with the following Rare Coins 101 Axiom:

Rare coins are NOT recommended as the first choice of investing for most people. This recommendation is not due to the possibility of getting swindled, it's more because of what long-term financial return numbers demonstrate, on average.

That’s just the honest-to-goodness truth.

This does not mean rare coins cannot do well when calculating bottom line percentage gains. They can, but there are other investment types that have historically outperformed rare coins when considered in the aggregate, leading to this axiom:

Developing a savings plan appropriately structured for your personal situation (time horizon, risk averseness, liquidity considerations, current net worth, etc.) should be the first priority for your investment dollars. For most people, that approach DOES NOT include rare coins initially.

Now that we’ve gotten this out on the table, let’s suppose you’ve already put in place a smart financial nest egg plan and still want to “play the market” with rare coins. Although other investment types may score better in the long term, rare coins aren’t anywhere close to last place in the competition either, so there are some interesting possibilities, for sure.

Before continuing on with coin investing, let’s review one more axiom, this one from the Collect First, Invest Second chapter:

If you are buying coins with the intent of reaping economic rewards, your chances of success are enhanced by first buying into the role of dedicated coin collector.

Now you’re basically caught up with previous chapters. All the necessary caveats have been laid bare.

Ready for some good news?

Well informed collectors REALLY CAN and DO earn respectable gains by investing in certain, carefully selected rare coins. This is not a myth.

Let’s get started…

- Odds Have Improved for Coin Investors of Today

- What Coins Hold the Highest Potential for Handsome Returns?

- Patience is a Must!

- Taxes

Odds Have Improved for Coin Investors of Today

For coin buyers in the mid-1980s and before, the playing field was riddled with many potholes. Fluid grading standards, shady dealers, and lack of easy liquidity were not imaginary perils. On top of that, there was too much guesswork as to the true scarcity of many collectible coins, especially in Uncirculated and Proof grades (a fact exploited by unethical promoters). For investors seeking a good return on rare coins, these concerns were amplified.

In 2026, the odds for success have improved dramatically for coin investors, largely driven by these developments:

Increased Coin Grading Standardization

In the mid-1980s, Professional Coin Grading Standards (PCGS) and Numismatic Guaranty Corporation (NGC) were formed to provide third-party coin grading services (NGC is now known as Numismatic Guaranty Company). They quickly earned a reputation for greater consistency and fairness, especially when compared to the prevailing winds in the coin business prior to their arrival.

Coins encased in PCGS or NGC holders inspired assurance in the marketplace of proper grading, eventually leading to the point where most coins of higher worth were sent to them for processing.

Confidence is so high many collectors and dealers are accustomed to buying a coin sight unseen if it has a PCGS or NGC label (and is being sold by a reputable seller).

Population Reports

A few years after their inception, PCGS and NGC started publishing Population Reports, containing counts of how many of every date and grade they handled. This was the first real chance to quantify true scarcity based on something more than conjecture.

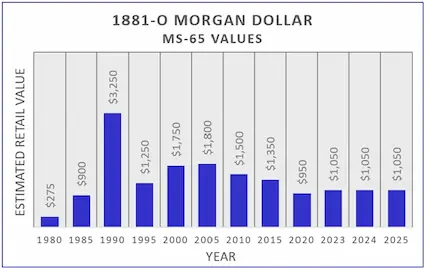

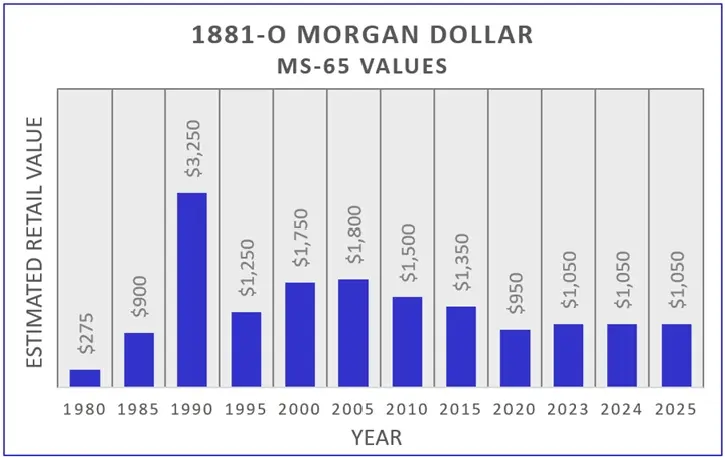

The numbers were eye-popping. Turns out quite a few “rare” dates weren’t so rare after all. An example of this is illustrated below on the MS-65 historic value trend chart for the 1881-O Morgan dollar (although this particular coin isn't chump change, either).

On the flip side, genuine rarities were confirmed. The positive impact of the Population Reports is that coin prices aligned more closely along natural lines of supply and demand.

Internet Connectivity

Nearly everyone today has a presence on the Internet, and this has done wonders for the coin market. At any moment, buyers can shop around with literally millions of coins to look at.

Sellers are pleased too as an exponentially larger clientele compared to the pre-Internet days contemplates their inventory. Widespread acceptance of cyber business has heightened revenues. In short, buying and selling coins has never been easier and safer.

In summary, better consistency in grading practices across the board was a major breakthrough for numismatics. Prices set on actual scarcity and collector popularity helped place the hobby on a more stable foundation. Coin marketplace activity was boosted immeasurably by Internet communications. All this makes it harder for fly-by-night sellers to ply their trade while improving liquidity for everyone.

It’s fair to say coin buyers of today have it better than preceding generations, and this benefits those viewing rare coins from the investment angle.

Read More About It...

The material in this section overlaps with that of other sections on this site. Read more about coin grading and third-party services. The importance of the Internet to coin collecting is covered in greater detail in the chapter where the future of the hobby is discussed.

What Coins Hold the Highest Potential for Handsome Returns?

Dispensing advice on coins likely to see price increases in the years ahead is the primary purpose of this site.

Sure, you’ll find elsewhere on this site many useful tidbits on the fundamentals of coin collecting: getting started, grading, etc. However, there are many coin websites covering these very same basics, and some do it quite well.

What makes Rare Coins 101 unique is how historic value trend data is researched and analyzed to identify key date coins.

Here is how we define a key date coin:

A key date coin is a coin of relative scarcity popularly sought by coin collectors. There is limited supply to meet demand, driving prices higher and faster over time compared to its common date counterparts.

Okay, so what does this foretell about future value trends? This Rare Coins 101 Axiom explains it all:

Key date coins that have historically been the most eagerly pursued by the collector base are the best bets for value appreciation in the years ahead.

These concepts are presented more thoroughly on our Home page.

Coins here that meet this high standard are documented over at our Key Date Coin List page. There is no charge to access this information.

You can go over there now and peruse the recommendations, but don’t forget to return here for the conversation on patience and taxes.

Patience is a Must!

Let’s say you’ve embraced coins from an investment stance. That means you’ve been absorbing numismatic knowledge like a dry sponge and have surged beyond the rudimentary basics of coin collecting. You have built a personal coin library and monitor auctions like a watchdog. You’ve attended shows and bonded with collectors having similar interests. You’ve found trustworthy dealers capable of delivering your carefully targeted coins at a fair price and understand how the marketplace operates. Your investment dollars have been spent and the coins are in your possession. Now what?

Wait. Patience is a must! It takes time, even for a quality rare coin, to rise sufficiently in value for the owner to reap a profit. If a coin goes up in value by just a few percentage points, this generally isn't enough to overcome the inherent obstacles to making money in coin investing.

Let's spend a few minutes talking about those obstacles...

Even the Best Rare Coins Do Not Constantly Rise in Value

Rare coins, even those destined for greatness, do not constantly rise in value. Sometimes they even take a few steps back. If profit is your motive, be prepared to buy and hold for a period of years, perhaps a decade or more. This is true for many investment types, but we can't overlook it here just because we have a bias toward coins.

Let’s study an example. The 1879-CC Coronet double eagle is exceptionally rare, issued by the fabled Carson City Mint. It has been coveted by collectors for more than 100 years as an artifact of historical and numismatic importance. This coin, in grade VF-20, was very lethargic throughout the 1990s, mired in the $825-$1100 range. After the turn of the millennium, the 1879-CC $20 recaptured the "Big Mo," rising to a retail value of about $4750 by 2014. A year later, after a few inexplicably weak sales, its listed retail value fell to $3500, a retreat that proved to be only temporary.

The 1879-CC’s rock star status was reaffirmed in subsequent years as buyers once again fought fiercely for this numismatic powerhouse. In 2026, the 1879-CC $20 in same grade sells in the $12,000 ballpark.(1)

Middleman Percentages

Another reason for patience is because if there is a middleman brokering the sale of your coins, he takes a big percentage off the top. Depending on the specifics of the situation, expect to lose anywhere in the neighborhood of 20 to 40%.

Many investors turn to renowned auction houses to market their coins because of the vast audiences they routinely attract. There is usually a consignment fee of up to 10% to be paid. The winning bidder pays a buyer's premium of up to 20%, but effectively, this cost comes out of the seller's pocket as well.

Many other sellers prefer the convenience and speed of wholesaling to dealers outright.

Another way of saying all this is that most collectors/investors buy at retail and sell at wholesale, or at least something close to that.

This means if you don’t hold your coin long enough to appreciate beyond the point where its current wholesale value exceeds what you paid for it, you may lose some of your investment. This is the most important explanation why collecting rare coins for profit generally requires a lengthy time horizon to be successful.

A growing number of sellers find retail buyers themselves through eBay, other online venues, coin clubs, or elsewhere. If you sell directly to another collector/investor, you may earn a larger percentage of retail, but it could be riskier and involve more of your time.

Other Costs

Before turning a profit, there are other costs associated with coin ownership that also must be overcome. These are:

- Sales tax: Some states and localities charge sales tax for coin purchases. That’s a real kick to the investor crotch because of the additional upfront acquisition cost.

- Storage & Insurance: Ongoing storage and insurance fees chip away at profit margins.

- Shipping: Postal rates to ship coins aren’t so bad, but insurance can be an eye opener. No one should ever ship valuable coins without adequate insurance coverage.

Use the Time to Your Advantage

In our fast-paced modern world, patience is generally not considered the virtue it once was. When it comes to coin investing, patience remains a virtue. In fact, it’s a requirement. You’ve got to give your coins time to catch the next powerful wave or two, something that may take many years, but will be worth the wait (this presumes you’ve smartly purchased coins with rosy futures – see Key Date Coin List). Don’t ever let anyone tell you this is a get rich quick venture. It is not, and never will be.

To those for whom patience is a challenge, look at it from another perspective. You get to spend more time viewing and studying your prized coins. You can build upon that while evaluating options for the next big foray into numismatic nirvana. Your coins are emissaries from the long ago past. What stories they could tell!

Once your family and friends hear you're an avid collector, you will inevitably be asked to appraise a few coins. Use those opportunities to captivate your audience with some material from your own collection, and soon you may be welcoming new collectors to the fold.

One of my heartfelt favorite coins is a heavily worn 1863 Indian Head cent I uncovered as a kid in a coin shop bargain bin. What was the first item it was used to purchase? Who were the people through whose hands it passed? Why, it’s possible this time voyager was within earshot of Abraham Lincoln as he delivered the Gettysburg Address. The possibilities boggle the mind!

So, don’t despair over the need for patience. It can be used to your advantage as a collector with investor motives. Be careful, you may get so attached to your coins you’ll never want to sell!

Taxes

As the old saying goes, nothing is certain in life except death and taxes. That means if you made a sweet profit on your 1895 Morgan dollar, the tax man will be coming soon with his outstretched hand.

Disclaimer: The tax information below is generalized and is not intended to be a substitute for professional advice on tax law. It does, however, give you an idea on the potential tax liability if you sell your coins at a profit or bequeath them to your family.

One advantage of rare coin ownership is unlike real estate and many other investments, you do not pay property taxes or any other taxes if you do not sell. You may own your coins as long as you wish without Uncle Sam or other ruling entity getting an annual cut. Another benefit is that no one is required to notify any government agency of your coin purchase, so your transaction will remain private and confidential.

Unfortunately, as in death, taxes become a certainty when coins are sold by an individual for more than s/he purchased them for. The tax laws governing coins and other collectibles are very complicated and subject to change. How long you owned your coins and where you fit into the IRS legal definitions of an investor, dealer, or collector weigh heavily in calculating your tax liability.

If you decide to get serious about investing in coins, it is strongly recommended to consult with a tax specialist before you get too far down the road, to minimize your eventual tax bill.

When it comes to collectibles taxation, the details can be perplexing. There are a few important essentials, however, that are readily understood and elementary:

- Cost Basis is how much you paid for the coin. Cost Basis includes cost of the coin plus any fees associated with the purchase, such as auction fees. Depending on your situation, you may be able to add travel expenses, insurance, storage, and other charges to the Cost Basis, so be sure to retain all receipts. The more you can lawfully add to the Cost Basis, the lower will be your tax burden when you sell.

- Taxable Income on selling a coin is computed as:

[what you sold the coin for] - [your Cost Basis for the coin] = Taxable Income

- Profits on coin sales are considered capital gains. If you owned your coin for one year or less, the profit is classified as a short-term capital gain. If owned for more than one year, the profit is reported as a long-term capital gain. The capital gains tax rates for coin collections are slightly different than those governing the sale of financial securities. The actual percent tax will vary according to individual circumstances and current tax law.

Also Important: When you pass along rare coins to loved ones, what you paid for them (i.e., YOUR Cost Basis) is irrelevant to their potential tax liability. Their Cost Basis becomes what the coins were worth at the time of your death and matters only should they decide to sell.

No one relishes paying taxes, but if you end up owing Uncle Sam a big bundle, look at it on the bright side: you made some really savvy decisions in your rare coin investments, so pat yourself on the back!

Quick Links to Other "Coin Investing" Chapters...

The next chapter in this section is Ready to Invest? Test Your Coin IQ First.

Use the links directly below to navigate the "Rare Coins as an Investment?" section:

- An Astounding Comparison

- Collect First, Invest Second

- Coin Investing in 2026 (the current chapter)

- Ready to Invest? Test Your Coin IQ First

All the chapters referenced above are accessible from any other chapter in this section. Thus, no need to return to this Introductory page to link to other chapters.

Sources

1. Gilkes, Paul, Senior Editor, U.S. Coins. Coin World Domestic Values. Sidney, OH. Amos Media Company. 2026.