Law of Supply & Demand

Question: When do coins become valuable?

Answer: When the Law of Supply & Demand says so.

Sorry for the terse "Smarty Pants" answer, but that's the explanation in a nutshell.

Ultimately, coin values are based on essentially the same set of rules as any other product bought and sold in the open marketplace. If everyone wants to buy without increasing the available supply, prices go up, but if everyone wants to sell, prices drop. The Law of Supply & Demand reigns supreme, whether it be coins or fuel prices.

Question: When do coins become valuable?

Answer: When the Law of Supply & Demand says so.

Sorry for the terse "Smarty Pants" answer, but that's the explanation in a nutshell.

Ultimately, coin values are based on essentially the same set of rules as any other product bought and sold in the open marketplace. If everyone wants to buy without increasing the available supply, prices go up, but if everyone wants to sell, prices drop. The Law of Supply & Demand reigns supreme, whether it be coins or fuel prices.

For coins, supply and demand is determined by factors specific to coin collecting. Each of the factors must be carefully considered to arrive at an estimation of the value of any particular coin. Collectors who understand how these factors combine to determine the fair market value of a coin are a leg up on those who do not.

Let's delve into the Law of Supply & Demand and how it sets the rules on when a coin becomes valuable. The good news is that it won't take you all day to get through this material:

A. When the Law of Supply & Demand says so!

That’s the snappy “Smarty Pants” answer. Ever wondered how to spot a Smarty Pants walking down the street? The drawing above should be helpful. Image by Shutterstock.

First, Let’s Talk Supply

First, let’s take a look at the supply portion of the Law of Supply & Demand and how it relates to coin values. What exactly is the supply? Broadly speaking, the supply of any coin of a specific date and mint mark can be defined as the number of examples available for sale at any point in time. What sets the parameters of availability? Let’s think of a 1796 Draped Bust quarter as an example as we step through the conversation.

First, let’s take a look at the supply portion of the Law of Supply & Demand and how it relates to coin values. What exactly is the supply? Broadly speaking, the supply of any coin of a specific date and mint mark can be defined as the number of examples available for sale at any point in time. What sets the parameters of availability? Let’s think of a 1796 Draped Bust quarter as an example as we step through the conversation.

Mintage

Mintage is the first indicator to be studied when guessing the available supply of any coin. The mintage of the 1796 Draped Bust quarter was a tiny 6,146 pieces,(2) and this sets the upper limit on how many could possibly have existed after 1796.

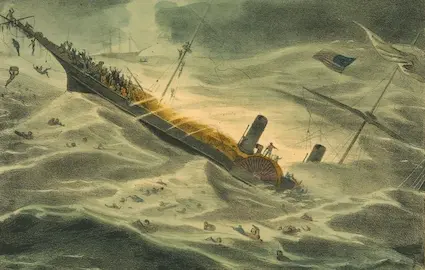

Survivorship is the most significant modifier to the original mintage figure. In the case of the 1796 quarter, many U.S. gold and silver coins perished in the late 18th and early 19th centuries when bullion profiteers shipped them in great numbers overseas, exploiting imbalances in international precious metals prices.(3)

There weren’t that many 1796 quarters to begin with, and of that number, quite a few of them ended up in the melting pot, leaving us today with a much smaller group of survivors to scramble for.

Mintage is the first indicator to be studied when guessing the available supply of any coin. The mintage of the 1796 Draped Bust quarter was a tiny 6,146 pieces,(2) and this sets the upper limit on how many could possibly have existed after 1796.

Survivorship is the most significant modifier to the original mintage figure. In the case of the 1796 quarter, many U.S. gold and silver coins perished in the late 18th and early 19th centuries when bullion profiteers shipped them in great numbers overseas, exploiting imbalances in international precious metals prices.(3)

There weren’t that many 1796 quarters to begin with, and of that number, quite a few of them ended up in the melting pot, leaving us today with a much smaller group of survivors to scramble for.

Another example of mintage modification occurred in 1918, when the Pittman Act authorized the destruction of over 270 million silver dollars!(5)

There are no records of which dates were melted under the Pittman Act, but many researchers tend to believe it hit the Morgan silver dollars fairly evenly across the board and was not the primary cause of any extreme rarities. On the other hand, some researchers speculate the Pittman Act may be the cause of the scarcity of 1892-S Morgan dollars in Mint State grade (see below).

What is certain is nearly half of the 570 Morgan dollars minted up to that point in time were destroyed in the Pittman melting pot. Talk about mintage modification!

Also, during the gold and silver boom of 1979-80, millions of silver coins were withdrawn from private collections and sold for a melt value temporarily far above their numismatic worth. Most likely some really good rarities got swept up in the hysteria and disappeared forever.

A massive precious metals boom is underway in 2026. In addition to some rarities probably getting swept away in the frenzy, the supply of many common date coins is diminishing. Could it be someday a 1921 Morgan becomes a not-so-common coin? (Probably not, but given the pace of the melting furnaces these days, who knows?)

What’s more, a huge number of collectible coins have been lost over the centuries, further reducing the supply. That belief is what keeps metal detectorists busy combing the countryside!

To state the situation more concisely, the supply of coins issued in the past is finite and generally can never significantly increase. There are exceptions to this, such as the massive discovery of coins in a shipwreck (see image and caption just below), in a previously unknown important hoard surfacing (read about the 1903-O Morgan silver dollar), or the finding of a 1794 Flowing Hair silver dollar hidden for centuries, but blockbuster headlines like this are very much out of the ordinary.

Condition

Condition is critical when considering supply availability. Condition is a numismatic term to express the state of preservation of a coin. The words “condition” and “grade” are used interchangeably in coin collecting jargon.

Coins are very durable, but seldom can collectible coins be found in the new condition they attained in being minted. From the instant a coin is ejected from the dies, it is gouged, handled roughly, and exposed to everyday wear.

Condition is critical when considering supply availability. Condition is a numismatic term to express the state of preservation of a coin. The words “condition” and “grade” are used interchangeably in coin collecting jargon.

Coins are very durable, but seldom can collectible coins be found in the new condition they attained in being minted. From the instant a coin is ejected from the dies, it is gouged, handled roughly, and exposed to everyday wear.

As you might expect, the quest for better grade specimens becomes more difficult because the supply generally gets smaller and smaller the higher you go on the grade scale. The degree of deterioration is estimated by the grade assigned to a coin by a collector, dealer, or coin grading service.

There is a numerical grade scale popularized by the American Numismatic Association and extensively used by collectors and coin professionals. Near the low end there is grade About Good (AG-03). At the opposite end we find Uncirculated (MS-60) or Proof (PF-60). The numerical scale ranges from 1 to 70, with 70 being perfect.(7)

As you might expect, the quest for better grade specimens becomes more difficult because the supply generally gets smaller and smaller the higher you go on the grade scale. The degree of deterioration is estimated by the grade assigned to a coin by a collector, dealer, or coin grading service.

There is a numerical grade scale popularized by the American Numismatic Association and extensively used by collectors and coin professionals. Near the low end there is grade About Good (AG-03). At the opposite end we find Uncirculated (MS-60) or Proof (PF-60). The numerical scale ranges from 1 to 70, with 70 being perfect.(7)

The grade can significantly effect a coin’s value because of its impact on supply. Continuing on with our 1796 Draped Bust quarter example, a specimen in AG-03 condition (a.k.a. About Good-03), which by definition exhibits very heavy wear, has an estimated retail price of $11,000. Moving up the scale several notches, a VF-35 (Very Fine) is valued at around $55,000. However, a 1796 quarter grading AU-58 (Almost Uncirculated) displaying very few traces of wear can fetch $85,000.(8)

A really stunning demonstration of how condition defines supply occurs with the 1892-S Morgan silver dollar. In the Almost Uncirculated (AU-50) grade, the coin retails for around $2250. In AU-58, the retail value jumps to at least $20,000, but when you get to MS-60 Uncirculated, the fun really begins.

Expect to pay at about $40K for a low level mint state example, and from there, prices skyrocket spectacularly.(9) As you may observe in the trio of 1892-S photos below, even the slightest amount of wear makes a very big difference.

Usually, coin values don't widen this dramatically over such a short range on the grading scale, but significant escalations from one grade to the next is not all that uncommon, so you see how critical the coin’s condition is in determining supply, and ultimately, value.

The grade can significantly effect a coin’s value because of its impact on supply. Continuing on with our 1796 Draped Bust quarter example, a specimen in AG-03 condition (a.k.a. About Good-03), which by definition exhibits very heavy wear, has an estimated retail price of $11,000. Moving up the scale several notches, a VF-35 (Very Fine) is valued at around $55,000. However, a 1796 quarter grading AU-58 (Almost Uncirculated) displaying very few traces of wear can fetch $85,000.(8)

A really stunning demonstration of how condition defines supply occurs with the 1892-S Morgan silver dollar. In the Almost Uncirculated (AU-50) grade, the coin retails for around $2250. In AU-58, the retail value jumps to at least $20,000, but when you get to MS-60 Uncirculated, the fun really begins.

Expect to pay at about $40K for a low level mint state example, and from there, prices skyrocket spectacularly.(9) As you may observe in the trio of 1892-S photos below, even the slightest amount of wear makes a very big difference.

Usually, coin values don't widen this dramatically over such a short range on the grading scale, but significant escalations from one grade to the next is not all that uncommon, so you see how critical the coin’s condition is in determining supply, and ultimately, value.

Grading is subjective and leads to varying opinions, and historically has been one of the less appealing aspects of coin collecting. Everyone has a grading opinion, and no two opinions are exactly the same every time. Rare Coins 101 has additional coverage of this topic at the What is Coin Grading? section.

And Now, An Overview of Demand

It is now time to review the factors creating demand. Collectors comprise the bulk of the demand side of the equation in the rare coin business. If there is no demand, there is no market, and therefore there would be little to no value in rare coins.

As we already know, collectors have been clamoring for rare U.S. coins for generations, some particular dates much more than others.

There would not be as many websites like this one if the demand for rare coins were on the same level as, say, anchovies.

Look at it this way: If anchovies were hugely popular, grocery stores would dedicate more shelf space to this terrible tasting little fish. Thankfully, rare coins are more welcome at our kitchen tables than anchovies!

Now that our Fish Market lesson for the day is over, let's get started discussing the most important factors generating demand for rare coins...

Series Popularity

Around the middle of the 19th century, the collection and study of U.S. coins became fashionable, leading to the founding of the American Numismatic Society in New York City in 1858. Many view this event as the formal launching pad for United States coin collecting.

From the get go, many hobbyists enjoyed acquiring an example from every year (and eventually mint mark) in an individual series of United States coins. That strategy remains widely practiced today. Such a collector who focuses on, let’s say, Mercury dimes, would want a specimen from each mint for every year the Mercury dime was issued, with the goal being to complete the entire set.

There are a few U.S. coin types that, over time, mainstream numismatic tradition has spotlighted as leaders of the pack. These include, but are not limited to: Indian Head cents, Lincoln cents, Buffalo nickels, Mercury dimes, Standing Liberty quarters, Walking Liberty half dollars, and Morgan silver dollars. Key dates in these groups (i.e., the scarcest of the bunch) experience heavy pressure from the collector class and consistently increase in value at a pace faster than most other collectible coins.

Thus, many 20th century coins with larger supplies carry premiums above their 19th century counterparts with smaller supplies, because more people actively seek the later date coins to round out their coin collector albums. For example, the demand for Lincoln cents in general is heavier than for Coronet large cents, since there are many times more people who are interested in Lincoln cents. A 1914-D Lincoln cent with an original mintage of 1,193,000 commands $150 in Good-4 condition, while an 1821 Coronet large cent in the same condition brings only about $75,(11)(12) even if only 389,000 were made (suggesting the existing supply of 1821 cents is much smaller).(13)(14)

There are a few U.S. coin types that, over time, mainstream numismatic tradition has spotlighted as leaders of the pack. These include, but are not limited to: Indian Head cents, Lincoln cents, Buffalo nickels, Mercury dimes, Standing Liberty quarters, Walking Liberty half dollars, and Morgan silver dollars. Key dates in these groups (i.e., the scarcest of the bunch) experience heavy pressure from the collector class and consistently increase in value at a pace faster than most other collectible coins.

Thus, many 20th century coins with larger supplies carry premiums above their 19th century counterparts with smaller supplies, because more people actively seek the later date coins to round out their coin collector albums. For example, the demand for Lincoln cents in general is heavier than for Coronet large cents, since there are many times more people who are interested in Lincoln cents. A 1914-D Lincoln cent with an original mintage of 1,193,000 commands $150 in Good-4 condition, while an 1821 Coronet large cent in the same condition brings only about $75,(11)(12) even if only 389,000 were made (suggesting the existing supply of 1821 cents is much smaller).(13)(14)

In recent years, rare gold coins have made significant strides, outperforming just about all other areas of U.S. coin collecting. Many of these are highlighted in the Key Date Coin List section and are primarily responsible for maintaining the Collectors Rare Coin Index at or near record high levels over the last decade or so.

Historical Significance

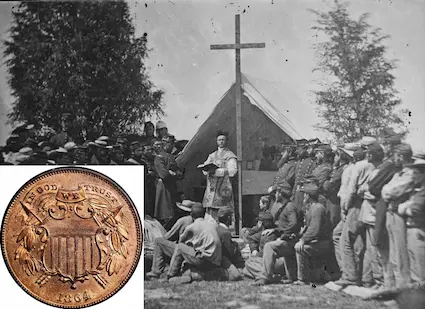

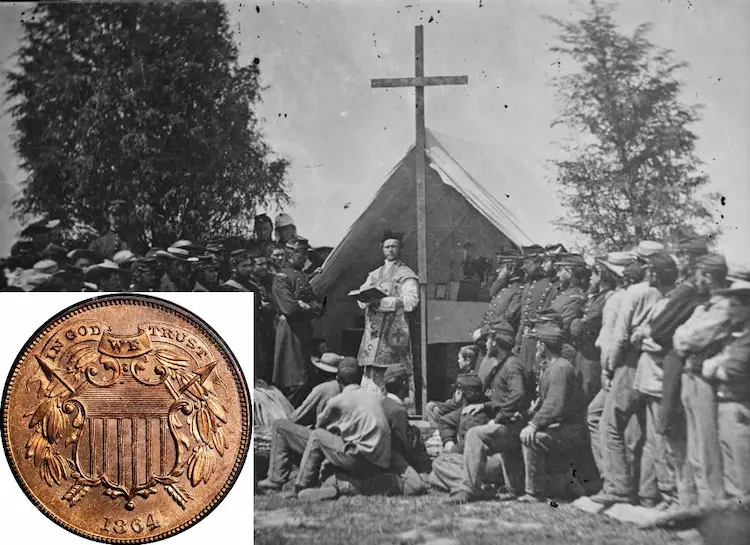

A large segment of the collector class also has a deep abiding respect for history, and views coins as time travelers of sorts. If only coins had the ability to talk, they could tell us first-hand what it was like during the early years of uncertainty following the ratification of the Constitution. Perhaps we could eavesdrop on an innkeeper from 1812 and sense the trepidation of the young, untested United States facing off against world-class power Great Britain in a military conflict. What must it have been like on the home front during the American Civil War as news of massive battlefield casualties stunned people from all walks of life?

America's story can be heard and literally felt through her coinage. Every coin from long ago, whether rare and valuable or simply a common date, is an eye witness to history. Concentrate and let your imagination run... it's almost possible to hear your 1864 Two Cent coin speak... what tales it could tell!

A large segment of the collector class also has a deep abiding respect for history, and views coins as time travelers of sorts. If only coins had the ability to talk, they could tell us first-hand what it was like during the early years of uncertainty following the ratification of the Constitution. Perhaps we could eavesdrop on an innkeeper from 1812 and sense the trepidation of the young, untested United States facing off against world-class power Great Britain in a military conflict. What must it have been like on the home front during the American Civil War as news of massive battlefield casualties stunned people from all walks of life?

America's story can be heard and literally felt through her coinage. Every coin from long ago, whether rare and valuable or simply a common date, is an eye witness to history. Concentrate and let your imagination run... it's almost possible to hear your 1864 Two Cent coin speak... what tales it could tell!

A combination of great historical significance and extreme rarity can indeed create some of the highest values. Consider the saga of the 1848 CAL. Coronet quarter eagle...

Following the 1848 discovery of gold in California, a very small shipment of newly found gold was sent back east, where it was coined into $2.50 quarter eagles at the Philadelphia Mint. The letters CAL. were stamped by mint workmen on the reverse of an estimated 1,389 quarter eagles dated 1848, to indicate they were made from California gold.(16) The 1848 CAL. quarter eagle is highly prized by modern day collectors, for its ties to the historical California Gold Rush.

A combination of great historical significance and extreme rarity can indeed create some of the highest values. Consider the saga of the 1848 CAL. Coronet quarter eagle...

Following the 1848 discovery of gold in California, a very small shipment of newly found gold was sent back east, where it was coined into $2.50 quarter eagles at the Philadelphia Mint. The letters CAL. were stamped by mint workmen on the reverse of an estimated 1,389 quarter eagles dated 1848, to indicate they were made from California gold.(16) The 1848 CAL. quarter eagle is highly prized by modern day collectors, for its ties to the historical California Gold Rush.

By now you get the picture; the possibilities are endless. In this light, all coins from times gone by have at least some collectible worth, far above face value, even those with relatively large supplies. Who in their right mind would spend an 1854 large cent at face value? (imagine the puzzled look of the cash register clerk!)

Coin Design

The design of a coin can have a bearing on its demand. Many numismatists seek to acquire a specimen of each design change in part or all of the entire United States coin types. They are called “type set collectors”, and this method of collecting puts pressure on certain designs minted for only a short period of time.

The 1796 Draped Bust quarter again illustrates this point. Aside from its obvious historical significance, it so happens 1796 was the only year the U.S. quarter was minted with a small eagle reverse, making it a one-of-a-kind coin. Type set collectors must compete ferociously with other buyers to acquire an example from the small available supply. The supply is nowhere near sufficient to meet demand which is what makes this coin so valuable.

The 1808 Capped Draped Bust quarter eagle has also earned a similar stardom:

The design of a coin can have a bearing on its demand. Many numismatists seek to acquire a specimen of each design change in part or all of the entire United States coin types. They are called “type set collectors”, and this method of collecting puts pressure on certain designs minted for only a short period of time.

The 1796 Draped Bust quarter again illustrates this point. Aside from its obvious historical significance, it so happens 1796 was the only year the U.S. quarter was minted with a small eagle reverse, making it a one-of-a-kind coin. Type set collectors must compete ferociously with other buyers to acquire an example from the small available supply. The supply is nowhere near sufficient to meet demand which is what makes this coin so valuable.

The 1808 Capped Draped Bust quarter eagle has also earned a similar stardom:

Precious Metal Content

Of the factors creating demand for coins, this is the one with the least amount of collector influence. In today’s environment, values rise and fall for common date 90% silver coinage (i.e. dated 1964 and earlier) mostly in tune with bullion market activity. The numismatic value component of these coins is small and does not fluctuate nearly as dramatically.

Returning for the final time to our 1796 Draped Bust quarter example, the market price of silver has absolutely no direct bearing on the worth of this rare United States coin. But for a heavily worn 1945 Mercury dime, the going rate of silver sure as heck does have a major impact on its retail value.

Common date gold coins (especially in lower grades), sometimes called generic gold, are likewise susceptible to value gyrations mirroring the movements of bullion prices. That’s because their gold metal content comprises a major portion of their value, with less emphasis on their collectible desirability.

For example, a common date 1903 Coronet Head $5 half eagle in Fine-12 condition, containing almost a quarter-ounce of pure gold, was retailing around $325 when gold was at $1000/oz. (of which $242 is due to melt value of the gold content). In today's ultra-hyper gold market, the exact same coin has jumped to maybe $1350, based on gold at $5300/oz. (of which about $1280 is due to melt value of the gold content).(19)(20) As you can see, most of its value is based on gold bullion content. For the 1903 and other generic gold coins, this is true until the very highest grades are reached.

Now let’s consider a close cousin to the aforementioned example, the 1870-CC Coronet Head $5 half eagle in Fine-12 condition. A true numismatic treasure, this coin retails for around $30K.(21) When the price of bullion gold moves up or down, the retail price of this rarity is lightly impacted, if at all, because its intrinsic bullion value is small compared to its numismatic integrity.

Keep this in mind: Longtime collectors may recall 1979, when the precious metal boom stimulated interest in bullion-based coins. Eventually, rare coins caught fire, lifting the entire coin market (only to collapse when gold and silver tanked). Some hobby insiders speculate if a similar big spike in bullion were to occur today**, rare coin prices would surge as well due to increased visibility.(22)

**2026 Update: That is indeed happening with the present gold/silver boom.

Registry Sets

Coin collecting has been around since the aristocrats of ancient Rome. During the Renaissance era of the 15th century, collecting emerged as the “hobby of kings”.(23) In the United States, interest in numismatics came of age in the 1850s to 1870s.(24)

Through the centuries, the acquisition strategies fueling collector demand have been much the same… until fairly recently.

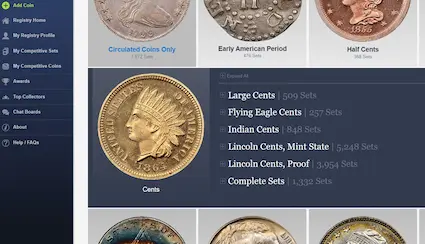

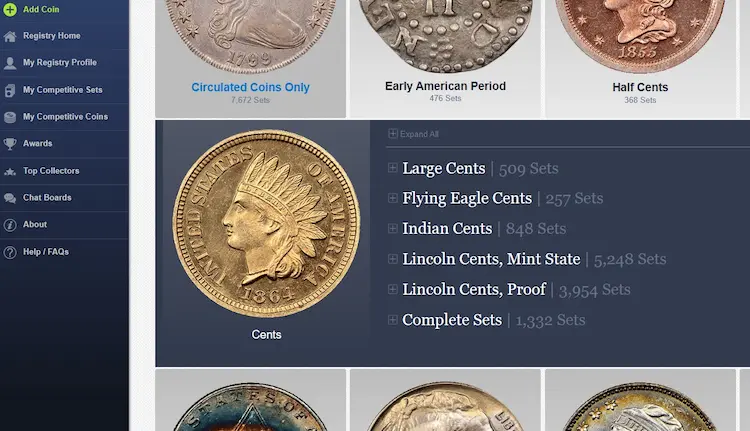

Now, in the age of modern communication and global networks, a new style of collecting exists that would make Caesar Augustus jealous. We call it “Registry Sets” and it is creating demand for collectible coins through motives never fathomed previously.

A Registry Set is a collection of PCGS and/or NGC certified coins catalogued in a public online venue. Collectors can show off their coins while competing against one other for recognition and prizes.

The two best-known coin grading companies, PCGS and NGC, have both built platforms to host Registry Sets. There is no fee to sign up.

Coin collecting has been around since the aristocrats of ancient Rome. During the Renaissance era of the 15th century, collecting emerged as the “hobby of kings”.(23) In the United States, interest in numismatics came of age in the 1850s to 1870s.(24)

Through the centuries, the acquisition strategies fueling collector demand have been much the same… until fairly recently.

Now, in the age of modern communication and global networks, a new style of collecting exists that would make Caesar Augustus jealous. We call it “Registry Sets” and it is creating demand for collectible coins through motives never fathomed previously.

A Registry Set is a collection of PCGS and/or NGC certified coins catalogued in a public online venue. Collectors can show off their coins while competing against one other for recognition and prizes.

The two best-known coin grading companies, PCGS and NGC, have both built platforms to host Registry Sets. There is no fee to sign up.

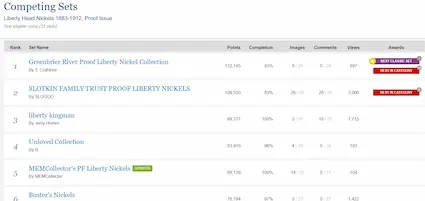

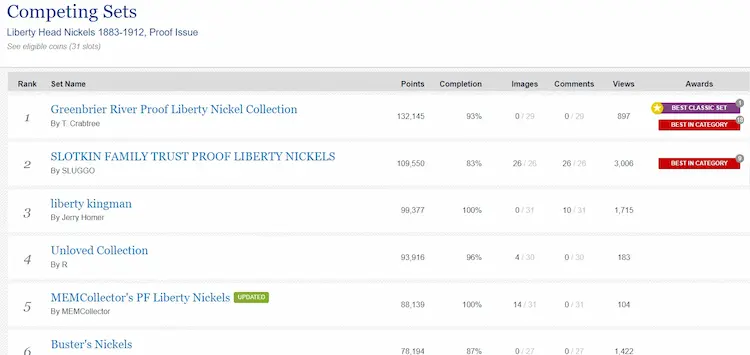

Here is basically how it works... Collectors form their coins into sets according to categories specified by the platform. For example, one category might be “Liberty Head Nickels 1883-1912, Proof Issues”. A collector with Proof Liberty Head nickels can register a set in this category. There are set categories spanning the entire collecting spectrum, including world coins. Custom categories are allowed if approved by the registry administrators.

In the NGC Registry, the collector submits a coin that will earn a certain number of points depending on the quality, rarity, and value of the coin. The points are summed for all the coins in the collector's set and then ranked against other sets registered with the category. The set with the highest point total gets the #1 ranking.

For PCGS Registry sets, the "Weighted Grade Point Average" is calculated and ranked. They take a different approach than NGC, but the fundamentals on how the sets are ranked (quality, rarity, value) are very much the same.

Here is basically how it works... Collectors form their coins into sets according to categories specified by the platform. For example, one category might be “Liberty Head Nickels 1883-1912, Proof Issues”. A collector with Proof Liberty Head nickels can register a set in this category. There are set categories spanning the entire collecting spectrum, including world coins. Custom categories are allowed if approved by the registry administrators.

In the NGC Registry, the collector submits a coin that will earn a certain number of points depending on the quality, rarity, and value of the coin. The points are summed for all the coins in the collector's set and then ranked against other sets registered with the category. The set with the highest point total gets the #1 ranking.

For PCGS Registry sets, the "Weighted Grade Point Average" is calculated and ranked. They take a different approach than NGC, but the fundamentals on how the sets are ranked (quality, rarity, value) are very much the same.

There are hundreds of thousands of registered sets and tens of thousands of participating collectors on the registry set platforms.

Needless to say, the competition to rank the highest is intense. One way a collector can move up in the point tally is to complete a set of coins with the highest imaginable grades. The #1 ranked set of Proof Liberty Head nickels shown above is a prime example.

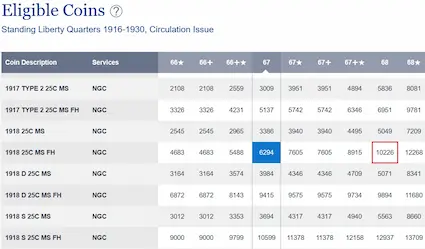

Let's look at another example from a different angle. The NGC Registry has a category “Standing Liberty Quarters 1916-1930, Circulation Issue”. To vie for the top spot in this category, many of the “slots” must be filled by certified MS-67 FH coins (learn what "FH" represents, as well as other Qualifiers signify HERE). If a set owner added one or more MS-68 FH’s, that single grading point difference could catapult the set much higher, perhaps into first place.

This screenshot shows how many points are awarded for certain 1918 Standing Liberty quarters in the higher grades:

There are hundreds of thousands of registered sets and tens of thousands of participating collectors on the registry set platforms.

Needless to say, the competition to rank the highest is intense. One way a collector can move up in the point tally is to complete a set of coins with the highest imaginable grades. The #1 ranked set of Proof Liberty Head nickels shown above is a prime example.

Let's look at another example from a different angle. The NGC Registry has a category “Standing Liberty Quarters 1916-1930, Circulation Issue”. To vie for the top spot in this category, many of the “slots” must be filled by certified MS-67 FH coins (learn what "FH" represents, as well as other Qualifiers signify HERE). If a set owner added one or more MS-68 FH’s, that single grading point difference could catapult the set much higher, perhaps into first place.

This screenshot shows how many points are awarded for certain 1918 Standing Liberty quarters in the higher grades:

Deep-pocketed collectors serious about their Registry Sets being ranked #1 have driven prices for some of the best available quality coins, even for common date material, to stratospheric levels. For them, seemingly no amount of money is too much to pay for a coin if it “one ups” a registry competitor.

It’s wise to question if the terrifically high prices being paid for many such coins is a passing fad whose bubble will someday pop. On a positive note, the Registry Set concept has broadened the demand for classic U.S. coin types.(25)

Registry Sets have sparked a new type of demand in numismatics, as collectors race against one another globally in a public forum to complete high quality collections. For coin collecting, Registry Sets are to the 21st century what the blue Whitman folding album was to the 20th century.

Quick Links to "What Makes a Coin Valuable?" Chapters...

Use the links directly below to navigate the "What Makes a Coin Valuable?" section:

- Law of Supply & Demand (the current chapter)

- Who "Sets" Current Coin Prices?

- Will Coin Collecting Thrive in the Years Ahead?

All the chapters referenced above are accessible from any other chapter in this section. Thus, no need to return to this Introductory page to link to other chapters.

Sources

1. PCGS. Draped Bust Quarter Price Guide. Jan 28, 2026.

2. Garrett, Jeff, et al. A Guide Book of United States Coins 2021 (aka the Redbook). Atlanta, GA. Whitman Publishing, 2020.

3. Q. David Bowers. The History of United States Coinage. Los Angeles, CA. Bowers & Ruddy Galleries, Inc. 1979.

4. Cochran, Steven. Morgan Silver Dollars – A Short History on the Pittman Act. Ormond Beach, FL. CoinWeek. Oct 9, 2013.

5. Garrett, Redbook.

6. Gibbs, William T. Deadly 1857 Hurricane Sinks SS Central America. Sidney, OH. Amos Media Company. May 16, 2014.

7. Bressett, Kenneth, and Bowers, Q. David. The Official American Numismatic Association Grading Standards for United States Coins, 7th ed. Pelham, AL. Whitman Publishing, 2019.

8. Gilkes, Paul, Senior Editor, U.S. Coins. Coin World Domestic Values. Sidney, OH. Amos Media Company. 2026.

9. Gilkes, Coin World Domestic Values.

10. Stack's Bowers Galleries. 1892-S Morgan Silver Dollar. MS-68 (PCGS). November 2020 Auction.

11. Gilkes, Coin World Domestic Values.

12. Gilkes, Coin World Domestic Values.

13. PCGS Coin Facts. 1821 Large Cent.

14. PCGS Coin Facts. 1914-D Lincoln Cent.

15. Bowers, History of U.S. Coinage.

16. Stack's Bowers Galleries. 1848 CAL. MS-61 (NGC). June 2008 Auction.

17. Gilkes, Coin World Domestic Values.

18. Heritage Auctions. 1808 Quarter Eagle, BD-1, MS61 Only Year of the Capped Bust Left, Large Size Type. April 2015 Auction.

19. Garrett, Redbook.

20. Gilkes, Coin World Domestic Values.

21. Gilkes, Coin World Domestic Values.

22. Garrett, Jeff. Do Bullion Prices Still Matter? Sarasota, FL. Certified Collectibles Group. September 1, 2022.

23. Britannica. Coin Collecting.

24. Bowers, History of U.S. Coinage.

25. Garrett, Jeff. The Difference a Point Makes. Sarasota, FL. Certified Collectibles Group. December 5, 2019.

As an Amazon Affiliate I earn from qualifying purchases, at no added cost to you. Thank you!